Take Back Control of Your Finances With OnTrees

We are living in tough economic times. A message some are getting bored of hearing and others are unfortunately living with every day. “We are all in this together”, is another line seemingly continually delivered by millionaire politicians that winds me up, although it’s now been derided and parodied so much that I think they’ve gotten the message and looked for another catchphrase to precede their next announcement of spending cuts.

Sadly, for many people it is a time of struggle, through no fault of their own, but as a nation, I can’t help thinking we did rather try to have our cake and eat it. From the late 90’s to early 2008, we enjoyed cheap credit and used it to indulge consumerism in a big way. Our governments did much the same and even where spending has been well intended, the belief that the economic boom and bust cycles were over and that we had discovered some higher economic formula were based on falsehood and people have been left with multiple maxed out credit cards and a lot of stuff they probably wonder why they were so keen on in the first place.

In spite of what happened, we’re still being encouraged to spend, all to get the wheels of economic recovery turning again. Interest rates are incredibly low, discouraging saving (penalising savers) and every shop and business is currently competing hard for our remaining monies.

In the light of all this, I’m of the firm belief that the real power comes from knowing exactly what your finances look like, knowing what your means are and then living just beneath them so that something can be put away for the future, to ride out unforeseen circumstances like the loss of a job, or prolonged illness.

I think a lot of people would do this, but we have a perception that it’s very complicated and that you’d need to be a maths genius to work it all out. Instead, we set up all our bills through direct-debit (where the invoices are automatically deducted from your bank account) and whatever is left after they’ve all gone out is spending money. Whilst this is very convenient, it does mean there is no breakdown of outgoings or an easy means to check that we’re getting the best deal. Many of us simply don’t know how much is being spent on say, the weekly food shop or perhaps that gym membership we’d simply forgotten about and instead just live month to month spending up the money that’s left over.

Well what if there were a way to get this break down without having to go back to school and dust off that scientific calculator we all got as children and immediately spelt out ‘boobless’ on?

This is where services like OnTrees can help.

By now, most folk are familiar with and use internet banking. OnTrees basically take your online statement information and give you some simple, powerful tools to help you get instant control of your finances and best of all, it’s free!

Before we get into any of the detail of the OnTrees offering, there is something you need to know and be at peace with. You will be registering your internet bank account access details with them. If you want to get the most complete picture of your finances, that means all your different accounts. For example I have three accounts with the same bank and another with a credit card company. In order to provide all the lovely charts and other data, OnTrees will need to read back the statement detail from your bank.

Sounds a bit scary, I’m sure you’ll agree. It’s up to you to reach a decision on this. I recommend a read of OnTrees’ FAQs on security here, but I’ll pick out a few of the highlights I noted that helped me decide I was happy to proceed.

First, OnTrees use the same level of security as the banks themselves do. This is called SSL and it creates a totally secure connection between your computer and the service (as noted by a padlock or an HTTPS at the beginning of the website address in your browser).

Second, OnTrees work with a partner and do not actually hold your account information themselves. The company they use is also used by banks, so you’re basically not doing anything different here than you are by accessing the bank itself, which may well use the same partner.

Finally, the data is hosted within the EU on Microsoft servers, which means it’s all under EU law and regulatory jurisdiction.

The important point is, even if someone else did gain access to your OnTrees account, they could not actually interact with your money.

If you’re still reading, perhaps you’re still curious?

Well, good, because if you’re okay with that, it’s all smooth sailing from here.

Setup is easy and you’re guided through the whole process. When adding each account, you can give it a name, perhaps something friendly to help you stay organised. I have an account for spending, one for billing and one for savings (and finally my credit card account), which keeps things pretty simple!

Your log on to OnTrees can be with an account you setup from scratch, or you can use your Google Mail (GMail) account, which is what I’ve done.

On logon, you’re presented with the OnTrees dashboard, which is the overview of all of your accounts. Down the left hand side, you can see your bank and credit accounts and how much (or how little!) money is in each of them. Then in the middle of the page is a nice pie chart, giving you an instant breakdown of where your money is being spent.

This is where OnTrees starts to empower you. For example, that daily stop in Starbucks on the way to work to grab a coffee-to-go. Only a few pounds right? Well, yes but a few pounds each and every time. But here you’ll see what that sum total each month actually is. I often wonder whether it’s these smaller payments that are catching us out. We’re surrounded by attractive, tasty, diverting luxuries like premium coffee, smartphone apps, discount (practically throwaway) clothes and so on, that cost so little at the till that they’re never given any consideration. But over time, these purchases add up and OnTrees will start to show you what you’re really spending as it automatically totals them all up in itemised fashion. Starbucks rue the day I realised how much I was spending with them every month!

Beneath the chart, you’ll see your recent transactions, which gives you an opportunity to check and make sure you recognise each entry (always good to know your account hasn’t been compromised - card cloning is more common than is admitted) and then on the right, you’ll see where OnTrees themselves hope to make money through financial package comparison services and the like.

The service is provided to you for free. However, they do hope you’ll look at the financial products they recommend and take up an offer or two. There’s no hard sell and they’ve certainly prioritised the functionality of their service, nothing is intrusive.

For many people, this may be enough, but if you really want to drill down and ask a few specific questions of your statement, you can. For example, you might decide you need to know how much you spent on petrol in the last 6 months, or how much cash you withdrew from the ATM and this is where the ‘Transactions’ section can help.

As you can see, you get a nice view of your bank account statement and across the top of the page, you can select ‘All Transactions’ across a chosen date range, across one or more accounts and then what category of transaction you want the total from.

The statement itself shows the categories that OnTrees has put your transactions into. These are effectively a best guess and it’s my recommendation that you occasionally comb through, as it won’t always have guessed right. I use the local supermarket for both groceries and petrol (better not mix those two up!) and they both appeared under the same grouping. Fortunately, you can change it and for regular purchases, you can set it to always use that same category next time. After a while, you’ll find you have to do this less and less.

I like to see how much I spend at the supermarket and on petrol each month. Most of my other bills are more or less fixed, but it’s a real help to get a quick answer to the ones that change and make sure I can anticipate any changes in my spending.

Now it’s time for some more pretty graphs. We’re told that both food and petrol prices are going up. This is a broad measure across the whole country. Wouldn’t it be nice to see what your personal spending trends are? Are you spending more on beer month on month? Is Tesco really seemingly infinitely ‘always dropping prices’ or has that bill actually crept up without you noticing (until now)?

The ‘Spending Trends’ section gives you immediate answers and again, helps you plan your spending over the long term, without wrestling with a calculator and Excel.

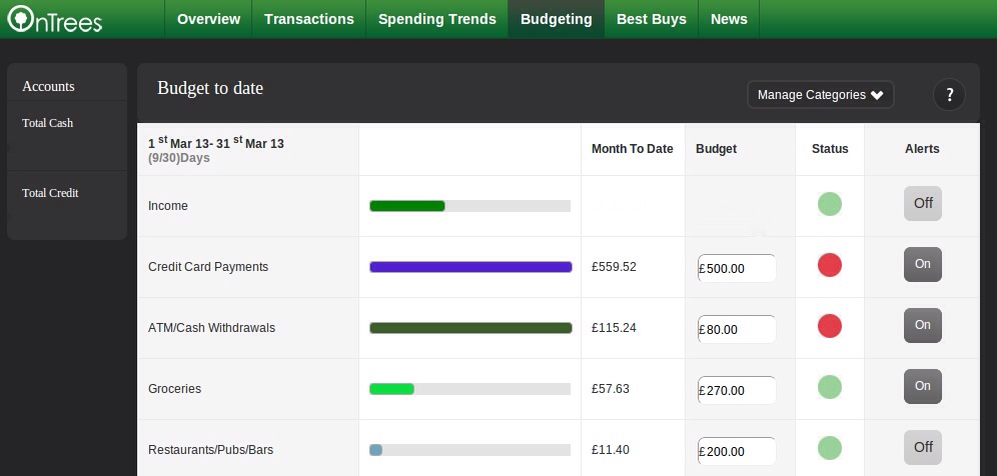

The final section is called ‘Budgeting’ and this aims to help you sensibly react to all the information you now have. Each of the categories you have gets an entry, for example the mortgage or your mobile phone spend. You can then allocate a budget to it. So let’s say you intend to spend no more per month than £300 on your supermarket shop. Enter 300 and set an alert and OnTrees will let you know when you start to approach that limit allowing you to try to limit yourself and keep things in line. This is possible for all the categories, so a small amount of effort when you first sign up and you can be warned when any of your spends creep up above what you wanted. Over time, this will help inform good habits, or at least draw your attention when things are looking less than healthy. I find this invaluable.

OnTrees then gives you simple tools to get more of a handle on your finances, prompts you when you’re overspending to help you adhere to budgets and gently advises you on financial products you might like to sign up to. Anything not to like?

Not really. OnTrees is a young company with a young product. The tools themselves are definitely enough for anyone who wants to get started, but I’m looking forward to the functionality they could add. The mobile app is iPhone only and a little basic (basic is fine for most, but the smartphone is king now and should be a priority platform). I can’t wait for an Android app (coming soon) and iPad owners would certainly appreciate a dedicated app too. Now I have my finances in some sort of order, I’d now like to take advantage and have tools that allow me to set goals for myself. There’s always a gadget or a holiday that I’m saving up for and something to reflect or encourage my progress would keep me coming back on an even more regular basis.

I’ve been in touch with OnTrees a few times whilst researching this post and they assure me they have big plans for the future, so if you’re not quite tempted yet, I certainly recommend OnTrees as a company to keep a close eye on!

Useful links:

Click here for the OnTrees Website

Jp

Photo Credits

Posted with Blogsy